The Travel Insurance Ideas

Wiki Article

Home Insurance - The Facts

Table of ContentsThe 30-Second Trick For Car Insurance QuotesThe Ultimate Guide To Cheap Car InsuranceThe Single Strategy To Use For Travel InsuranceTravel Insurance for BeginnersHome Insurance Fundamentals Explained

If your employer doesn't provide the kind of insurance you desire, obtain quotes from several insurance coverage carriers. While insurance policy is costly, not having it can be much a lot more pricey.It seems like a pain when you don't need it, however when you do require it, you're freakin' happy to have it there (life insurance). It's everything about transferring the risk right here. Without insurance policy, you can be one automobile wreck, illness or emergency far from having a big money mess on your hands.

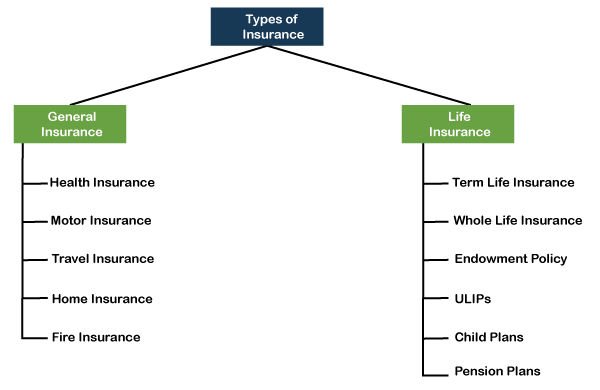

Uncertain what the distinction is between every one of these? Have no fearwe'll damage down every little thing you require to know concerning each of these sorts of insurance. 1. Term Life Insurance Policy If there's just one kind of insurance coverage that you enroll in after reading this, make it call life insurance policy.

What Does Insurance Do?

No damage, no nasty. Assume concerning this: The younger you are, the a lot more affordable term life insurance policy is. And also you're never ever mosting likely to be younger than you are today. All that to state, if it's something you assume you might utilize in the future, it's more affordable to get it now than in 15 years.Automobile Insurance coverage You should never drive about uninsurednot just because it's against the legislation yet likewise since obtaining in a fender bender can be ex-pen-sive. The Insurance policy Information Institute claims the average loss per case on vehicles is around $1,057.

And flooding insurance policy is additionally different than water backup security. A representative can assist you make sense of it all. If you do not live anywhere near a body of water, this insurance isn't for you.

Life Insurance - Questions

Bear in mind, if you do not have wind insurance policy protection or a separate storm insurance deductible, your home owners insurance plan will not cover hurricane damages. Depending on where you live in the country, earthquake protection could not be consisted of in your house owners coverage. If you reside in a place where quakes are understood to shake things up, you could wish to tack it on check these guys out to your plan.Without occupants insurance coverage, it depends on you to replace your valuables if they're lost in a fire, flood, theft or a few other catastrophe. And also, a great deal of property owners and also apartment or condos will require you to have occupants insurance policy as well. A good independent insurance policy agent can walk you through the actions of covering the essentials of both property owners and also renters insurance policy.

Don't place on your own because placement by not having health insurance policy. The high price of clinical insurance isn't an excuse to do without coverageeven if you don't most likely to the doctor a great deal. To help reduce on the price of medical insurance, you can obtain a high-deductible medical insurance strategy.

You can invest the funds you add to your HSA, as well as they grow tax-free for you to use currently or in Visit Website the future. You can make use of the cash tax-free on qualified medical expenditures like health insurance deductibles, vision and also oral. Some business currently provide high-deductible health insurance with HSA accounts as well as standard wellness insurance policy strategies.

Things about Home Insurance

Insurance policy uses assurance against the unexpected. You can discover a policy to cover virtually anything, but some are more essential than others. All of it relies on your requirements. As you draw up your future, these four kinds of insurance ought to be securely on your radar. 1. Auto Insurance policy Automobile insurance policy is crucial if you drive.Some states likewise need you to carry accident protection (PIP) and/or uninsured driver insurance coverage. These protections pay for medical costs associated to the case for you and also your guests, despite that is at mistake. This additionally helps cover hit-and-run accidents and accidents with vehicle drivers who don't have insurance.

Yet if you do not acquire your own, your lender can get it for you and also send you the costs. This might come with a greater price and also with much less insurance coverage. Home insurance coverage is an excellent concept also if you have actually settled your you can look here home mortgage. That's because it guards you versus expenses for residential or commercial property damage.

In the occasion of a burglary, fire, or disaster, your occupant's policy must cover many of the expenses. It may additionally assist you pay if you have to remain in other places while your house is being repaired. Plus, like house insurance coverage, occupants provides liability protection.

Life Insurance - An Overview

That way, you can preserve your wellness and wellness to meet life's demands.Report this wiki page